Mis sold car finance occurs when consumers are misled into agreements with hidden costs, unclear terms, and aggressive sales tactics. Vulnerable groups like first-time buyers, low-income individuals, and those with limited financial literacy are at higher risk. To protect themselves, consumers should seek independent advice, review contracts thoroughly, and be wary of deceptive practices. Legal recourse is available through regulatory bodies or arbitration for victims seeking compensation. Staying informed, reviewing terms carefully, comparing offers, and avoiding pressured decisions can help prevent mis sold car finance.

Mis sold car finance is a significant issue affecting countless individuals who find themselves entangled in complex financial agreements. This comprehensive guide aims to demystify the concept, offering insights into understanding, identifying, and navigating mis sold car finance scenarios. From recognizing vulnerable consumers to uncovering deceptive tactics and exploring legal rights, we provide essential tools to empower buyers. Additionally, practical tips are offered to prevent future falls victim to these schemes.

- Understanding Mis Sold Car Finance: A Comprehensive Guide

- Who is at Risk of Being Mis Sold? Identifying Vulnerable Consumers

- Uncovering the Tactics: How Dealers and Lenders Mis Lead Buyers

- The Legal Framework: Rights and Recourse for Victims

- Preventive Measures: Tips to Avoid Falling Victim to Mis Sold Car Finance Schemes

Understanding Mis Sold Car Finance: A Comprehensive Guide

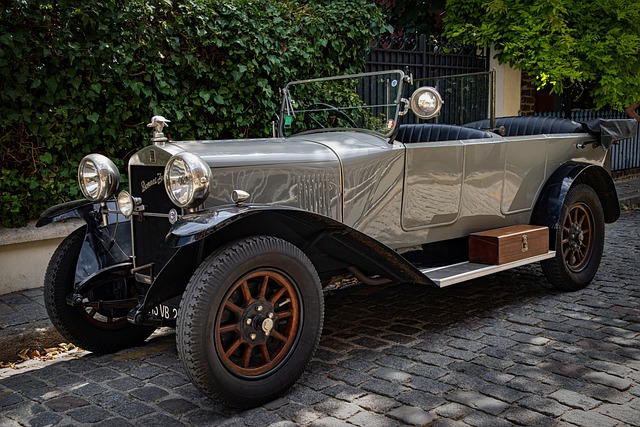

Mis sold car finance occurs when a consumer is sold a car finance agreement that does not meet their needs or expectations, often due to misleading information or a lack of transparency from the seller. This can include situations where the interest rates are excessive, the terms and conditions are not fully explained, or the finance is pushed as a necessity rather than an optional extra. It’s crucial for consumers to be aware of their rights in such cases.

A comprehensive guide to understanding mis sold car finance begins with recognizing the signs. These may include unexpected or high-pressure sales tactics, inadequate disclosures about interest rates and fees, and a lack of clear information about repayment terms. Consumers should always read and understand the fine print before signing any financial agreement. Additionally, seeking independent advice from financial experts or consumer protection agencies can help ensure that the deal is fair and suitable for their circumstances.

Who is at Risk of Being Mis Sold? Identifying Vulnerable Consumers

Anyone who has taken out a loan or financing agreement for a car purchase could be at risk of mis-selling. However, certain groups are more vulnerable than others. The most susceptible consumers often include those with limited financial literacy, first-time car buyers, older adults, and individuals with low income or poor credit scores.

Mis-selling can occur when a dealer or financier doesn’t fully disclose all costs associated with the loan, offers aggressive sales tactics, or pressures customers into accepting terms they don’t fully understand. Vulnerable consumers might not recognize these practices, leading to unforeseen financial strain and higher costs than expected. Therefore, it’s crucial for them to be vigilant, seek independent advice, and thoroughly review all contract documents before signing.

Uncovering the Tactics: How Dealers and Lenders Mis Lead Buyers

Dealers and lenders often employ various tactics to mislead car finance buyers, leading to mis sold car finance agreements. They may use complex language and hidden fees to confuse customers during the sales process. Unsuspecting buyers might be enticed with attractive offers, only to discover later that they’ve agreed to terms that are not in their best interest.

Another common tactic is omitting important information about repayment schedules, interest rates, and additional charges. Buyers may feel pressured into making quick decisions without thoroughly understanding the financial implications. These deceptive practices can result in buyers facing unexpected costs, higher monthly payments, or even default on their loans—a significant burden that could have been avoided through transparent communication and careful consideration of individual financial capabilities.

The Legal Framework: Rights and Recourse for Victims

When it comes to mis sold car finance, understanding the legal framework is crucial for victims seeking recourse. In many jurisdictions, there are stringent laws in place to protect consumers from unfair practices in financial transactions, including car loans. These regulations provide clear rights and defined avenues for those who have been misled or treated unfairly during the purchase of a vehicle through finance.

Victims of mis sold car finance can take legal action, such as filing complaints with regulatory bodies or seeking arbitration. They may be entitled to compensation for any financial losses incurred, including the difference between the original loan terms and a fair market value. It’s important for individuals in this situation to gather all relevant documents and seek professional advice to understand their rights and the best course of action under the prevailing legal framework.

Preventive Measures: Tips to Avoid Falling Victim to Mis Sold Car Finance Schemes

To prevent falling victim to mis sold car finance schemes, it’s crucial to be informed and vigilant. Always remember to thoroughly research any financing options before committing. Check the terms and conditions carefully, ensuring you understand the interest rates, repayment periods, and any hidden fees. It’s wise to get multiple quotes from different lenders to compare offers and identify potential red flags. Additionally, never feel pressured into a quick decision; take your time to assess the deal.

Another key measure is to verify the legitimacy of the lender. Reputable financial institutions typically have transparent practices and will provide clear information about the finance process. Be wary of deals that seem too good to be true, or those demanding upfront payments or unusual repayment methods. Regularly reviewing your statements can also help you quickly identify any discrepancies or suspicious activities, enabling you to take immediate action against potential mis-selling.

Mis sold car finance is a serious issue that can leave consumers with significant financial and emotional strain. By understanding the tactics used by dealers and lenders, identifying vulnerable consumers, and knowing their legal rights, individuals can better protect themselves from falling victim to these schemes. Taking preventive measures such as thorough research and seeking expert advice is crucial in avoiding mis sold car finance traps. Staying informed and armed with knowledge is the best defense against this deceptive practice.